Advertiser Disclosure

How to Find Your Student Loan Balance

Updated On October 29, 2021

Editorial Note: This content is based solely on the author's opinions and is not provided, approved, endorsed or reviewed by any financial institution or partner.

If you have student loans, you may be wondering how to find your student loan balance. It’s common for borrowers to have multiple federal student loans and private student loans. However, it can be challenging to keep track of your student loan balances, lenders, student loan servicers, and other important information about your student loans.Fortunately, there’s a helpful solution to calculate your student loan debt, and it’s called the National Student Loan Data System (NSLDS).

In this post, we will discuss:

- What is the National Student Loan Data System?

- How much do I owe in student loans?

- How to find the balance on your federal student loans

- How to find the balance on your private student loans

- Your next steps to manage student loans

Top Picks For Student Loan Refinancing

October 2024

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

Disclosures: SoFi | Earnest | NaviRefi | ELFI | Splash Financial | Citizens | Laurel Road | LendKey

What is the National Student Loan Data System?

The National Student Loan Data System (NSLDS) is a student loan database that contains information about your federal student loans. The NSLDS, which is managed by the U.S. Department of Education, aggregates student loan information from schools, guaranty agencies and the Direct Loan programto give you a full view of your student loans and grants. The NSLDS website is located at is available 24 hours a day, seven days a week.

The NSLDS shows your loan balance, type of loan and repayment status. For example, the NSLDS shows whether you are in grace period, repayment, forbearance, deferment or paid off. You can also understand which loans are subsidized or unsubsidized. Unfortunately, the NSLDS will not show you information regarding your private student loans or Parent PLUS Loans.

National Student Loan Data System (NSLDS) Contact Information

There are several ways to contact the National Student Loan Data System customer service:

Phone Number: 1-800-999-8219

NSLDS Customer Support is available Monday through Friday from 8 am to 9 pm ETEmail: You can email NSLDS at nslds@ed.gov.

Mailing Address:

National Student Loan Data System, FSA

U.S. Department of Education

830 First Street NE, 4th Floor

Washington, D.C.

20202-5454

If you discover an error in the NSLDS, you should first contact your student loan servicer to correct the incorrect information.

How much do I owe in student loans?

If you have student loans, you may be wondering: “How much do I owe in student loans?” How much you owe in student loans can change over time. When you first borrowed student loans, you borrowed a specific amount of student loan debt. That student loan debt had an interest rate that caused your student loan balance to increase. As a result, your student loan balance today may be higher than what you originally borrowed.

It’s also possible that your student loans may have been transferred or sold to a new student loan servicer, which is a common practice in the student loan industry. Therefore, it’s important to identify your current student loan servicer so you know where and how to make student loan payments.

If you owe student loan debt, it’s essential that you know how much you owe in student loans. The National Student Loan Data System can provide you with an accurate student loan balance so you know how much you owe in student loans. You should log in to your NSLDS account regularly to check your student loan balance. As you repay student loan debt, you can track your student loan balance get paid off.

How to find the balance on your federal student loans

To find the balance on your federal student loans, access the NSLDS student loan database. This is the most comprehensive central database for all federal student loans.

Here are the stepsto find the balance on your federal student loans:

- Go to the NSLDS website.

- Click “Financial Aid Review.”

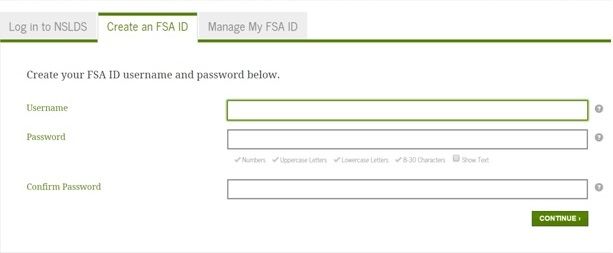

- Create a new account with a Federal Student Aid (FSA) ID.

- Provide the requested information, including an email address and your Social Security Number.

Once you create your NSLDS account, you can login to the student loan database as often you would like to check your federal student loan balance. Once you’re logged in, review the list of all federal student loans associated with your name. You can check your current loan balance, original amount borrowed, interest rates, payment status and student loan servicers. It’s important to remember that information on the NSLDS website may be old as 120 days. Therefore, it’s possible that your loan information may be out of date.

One alternative to the NSLDS website is to contact your school’s financial aid office. A financial aid officer can provide you with how much student loan debt you borrowed, the original amount of your student loans and the name of your student loan servicer. Then, you can contact your student loan servicer to learn your student loan balance.

How to find the balance on your private student loans

Remember, the NSLDS database is only for federal student loans, so it will not include the balance on your private student loans.

How do you find the balance on your private student loans? Follow these easy steps:

- Grab a free copy of your credit report from the three major credit bureaus—Equifax, Experian and TransUnion—through AnnualCreditReport.com.

- Your credit report will show your current private student loan balance and the name of your student loan servicer.

- Contact your student loan servicer so you can start making payments on your student loans.

Your next steps to manage student loans

Many borrowers ask: “How much do I have in student loans?” Now that you know how to find your student loan balance and the name of your student loan servicer, it’s important to focus on student loan debt repayment. There are many strategies to lower your interest rate, lower your student loan payment, and pay off student loan debt faster. You also may choose to refinance your student loans so get a lower interest rate and get out of debt more quickly. This student loan refinancing calculator shows you how much money you can save when you refinance student loans.